SaaS vs. On-Premise Accounting Software: Let’s Break It Down

Not all businesses need accounting software, but it’s undeniable how handy it can end up being. A well-suited accounting software can efficiently manage finances, track income and expenses, ensure tax compliance, and provide valuable insights into your business performance.

There are different approaches you can do this. How you keep track of your finances mainly depends on the size of your company and its financial complexity. Self-employed individuals or freelancers might opt for manual bookkeeping methods, using a notebook and pen. Small businesses might smell a need for organizing everything into spreadsheets so that it helps with saving time and future reference.

But as your business expands and financial intricacies grow, relying solely on these methods may result in a tangled web of finances. While automating certain processes may initially seem efficient, it could lead to a spaghetti of accounts, requiring frequent manual intervention and rendering the software ineffective. This, in turn, may incur additional costs through hired personnel for data entries, lost time, diminished client trust, and a less reliable financial tracking system overall.

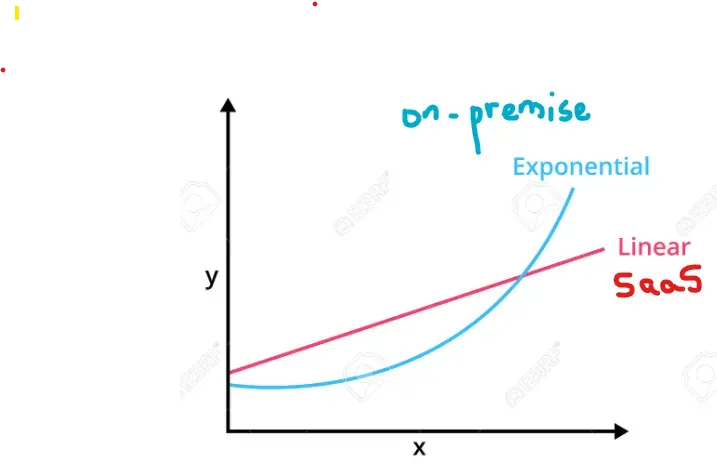

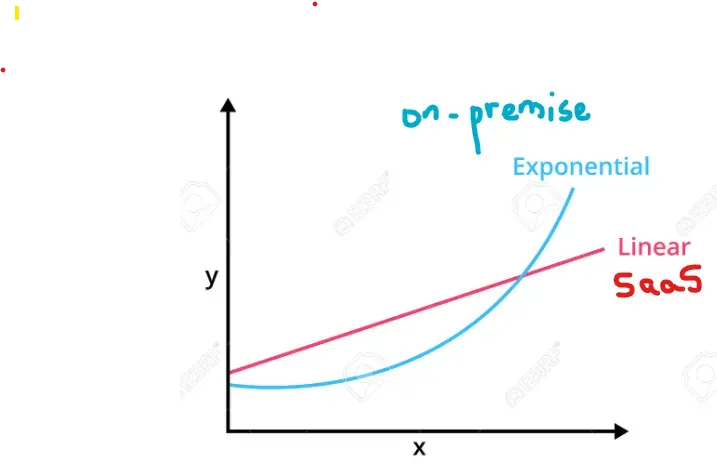

At this point, you might opt for a one-time cost on an on-premise software like Tally, or paying a recurring subscription fee for a SaaS (Software as a Service). In this blog, we’ll dive deeper into the pros and cons of using both traditional software and SaaS for your business, and understand total costs of ownership for what suits your business the best, so that you don’t have to.

1. Cost

Traditional software usually requires a one-time purchase, which can be a significant upfront cost, but there are no recurring fees unless you opt for updates or support. On the other hand, SaaS operates on a subscription model, meaning you pay a recurring fee, often monthly or annually. This can be more manageable for businesses with tight cash flow. SaaS services are scalable, meaning you can increase or decrease your service usage, but you’ll always end up paying only for what you use.

2. Installation Methods

Traditional software needs to be installed on each device that will use it, which can be time-consuming and require technical knowledge. SaaS, however, is cloud-based and accessible via the internet, eliminating the need for installation and making it easier to get up and running.

3. Accessibility and Device Dependency

With traditional software, you’re limited to the device it’s installed on, which can restrict when and where you can access your financial data. SaaS offers more flexibility on this, with the ability to access your data from any device as long as you have a stable internet connection, making it a good option for businesses with remote workers or multiple locations.

4. General vs Tailored

Traditional software may offer a more comprehensive feature set, but it may also include many features you don’t need, making it more complex to use. SaaS providers often offer a range of plans with different features, allowing you to choose the one that best fits your business needs and budget.

5. Security

Both traditional software and SaaS have their own security considerations. With traditional software, your data is stored on your own servers or devices, so you have full control over its security. However, this also means you’re responsible for maintaining that security. SaaS providers store data on the cloud and handle security on their end. Often, the resources employed by SaaS providers use robust security measures, but you’re entrusting your sensitive financial data to a third party.

6. Server Setup

Traditional software requires you to have your own server setup, which can be costly and require ongoing maintenance. SaaS is hosted on the provider’s servers, reducing the need for you to invest in and maintain your own server infrastructure.

7. Compatibility

Traditional software may not always play well with other systems you’re using, which can lead to inefficiencies and frustration. SaaS is typically designed to integrate easily with other popular software, helping to streamline your workflows.

The choice between traditional software and SaaS depends on your specific business needs, budget, and resources. There are multiple accounting software providers but it is difficult to carefully consider what suits your business the best.

That is why we have Tigg. Tigg is the ultimate, all in one business management software, aimed at small and medium businesses (MSMEs) to manage all your business needs such as Accounting, CRM and sales in a single place.

Our cloud-based accounting system is specially designed to target the needs of Nepali SMEs to manage their finances & taxes so that we can give you real-time business intelligence you need to chase growth.